FREE ZONES IN TURKEY

Definition of Free Zone

In general, free zones are defined as special sites within the country that are deemed to be outside of the customs territory. Free Zones are also defined as fenced-in areas in which special regulatory treatment exists for the operating users in order to promote exports of goods and services. Free zones offer more convenient and flexible business climate in order to increase trade volume and export for some industrial and commercial activities as compared to the other parts of country. With the aim of increasing and promoting export-oriented investment and production, 18 free zones have become operational since 1985.

There are three different special investment zones in Turkey:

1. Technology Development Zones - Technoparks

Technology Development Zones (TDZ) are areas designed to support R&D activities and attract investments in high-technology fields. There are 84 TDZs, of which 63 are operational and 21 have been approved and are currently under construction.

2. Organized Industrial Zones

Organized Industrial Zones (OIZ) are designed to allow companies to operate within an investor-friendly environment with ready-to-use infrastructure and social facilities. The existing infrastructure provided in OIZs includes roads, water, natural gas, electricity, communications, waste treatment and other services.

There are 353 OIZs in 81 provinces, 258 of which are currently operational, while the remaining 95 OIZs are being constructed throughout Turkey. In addition, more than 67,000 companies produce in over 32,000 parcels while more than 2 million people are employed through the OIZs.

3. Free Zones

Free zones (FZ) are special sites deemed outside the customs area, although they are physically located within the political borders of the country. FZs are designed to boost the number of export-focused investments. Legal and administrative regulations in the commercial, financial and economic domains that are applicable within the customs area are either not implemented or partially implemented in FZs.

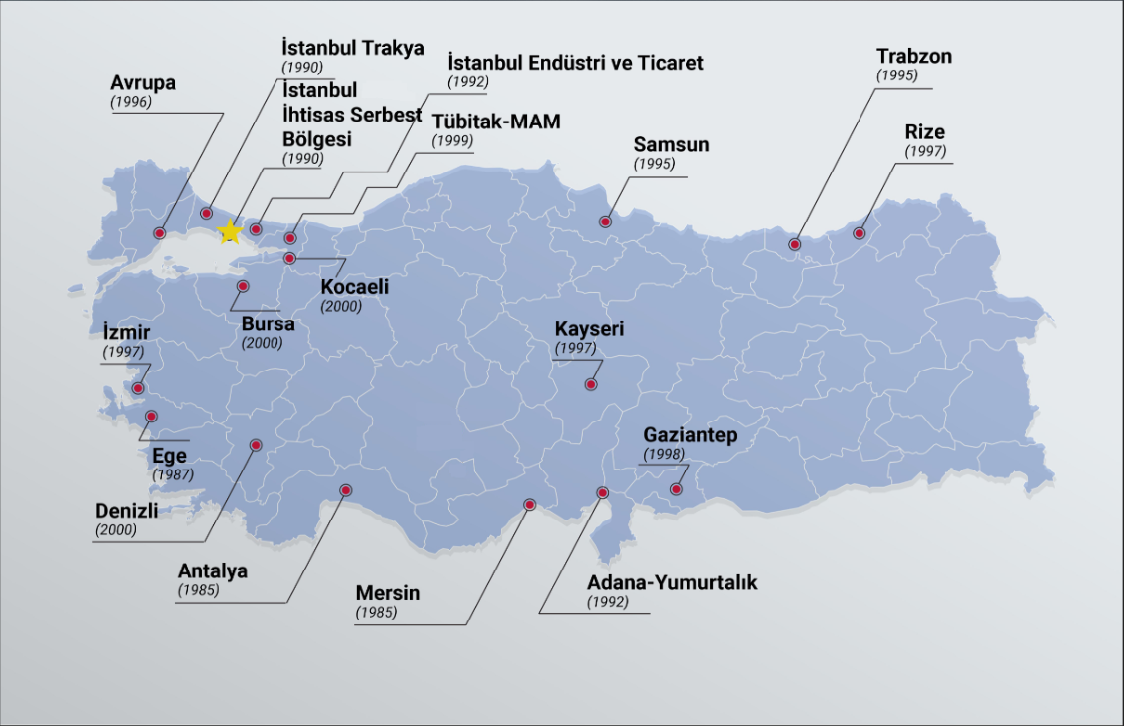

There are a total of 19 Free Zones in Turkey located close to the EU and Middle Eastern markets, 18 of which are active and 1 is at the stage of establishment. FZs are strategically located at points that grant easy access to international trade routes via ports on the Mediterranean, Aegean Sea, and the Black Sea.

Advantages of FZs

100% exemption from customs duties and other assorted duties.

100% exemption from corporate income tax for manufacturing companies.

100% exemption from value-added tax (VAT) and special consumption tax.

100% exemption from stamp duty for applicable documents.

100% exemption from the real estate tax.

100% income and corporate tax exemption for certain logistics services to be offered at the FZs, provided that they are export-oriented.

100% exemption from income tax on employees’ wages (for companies that export at least 85% of the FOB value of the goods they produce in the FZs.

Goods may remain in FZs for an unlimited period.

Companies are free to transfer profits from FZs to abroad as well as to Turkey, without restrictions.

Exemption from title deed fees when acquiring and selling a property.

VAT exemption during construction, design, settlement, and approval processes.

Ready infrastructure exempt from VAT and other taxes.

Import permit for second-hand, used machinery.

Free Zones in Turkiye

|

FREE ZONES IN Turkiye |

DATE OF EST. |

|

|

1 |

MERSIN FREE ZONE |

1985 |

|

2 |

ANTALYA FREE ZONE |

1985 |

|

3 |

AEGEAN FREE ZONE |

1987 |

|

4 |

ISTANBUL ATATURK AIRPORT FREE ZONE |

1990 |

|

5 |

TRABZON FREE ZONE |

1990 |

|

6 |

ISTANBUL THRACE FREE ZONE |

1990 |

|

7 |

ADANA YUMURTALIK FREE ZONE |

1992 |

|

8 |

ISTANBUL INDUSTRY & TRADE FREE ZONE |

1992 |

|

9 |

SAMSUN FREE ZONE |

1995 |

|

10 |

EUROPE FREE ZONE |

1996 |

|

11 |

RIZE FREE ZONE |

1997 |

|

12 |

KAYSERI FREE ZONE |

1997 |

|

13 |

IZMIR FREE ZONE |

1997 |

|

14 |

GAZIANTEP FREE ZONE |

1998 |

|

15 |

TUBITAK-MRC FREE ZONE |

1999 |

|

16 |

DENIZLI FREE ZONE |

2000 |

|

17 |

BURSA FREE ZONE |

2000 |

|

18 |

KOCAELI FREE ZONE |

2000 |